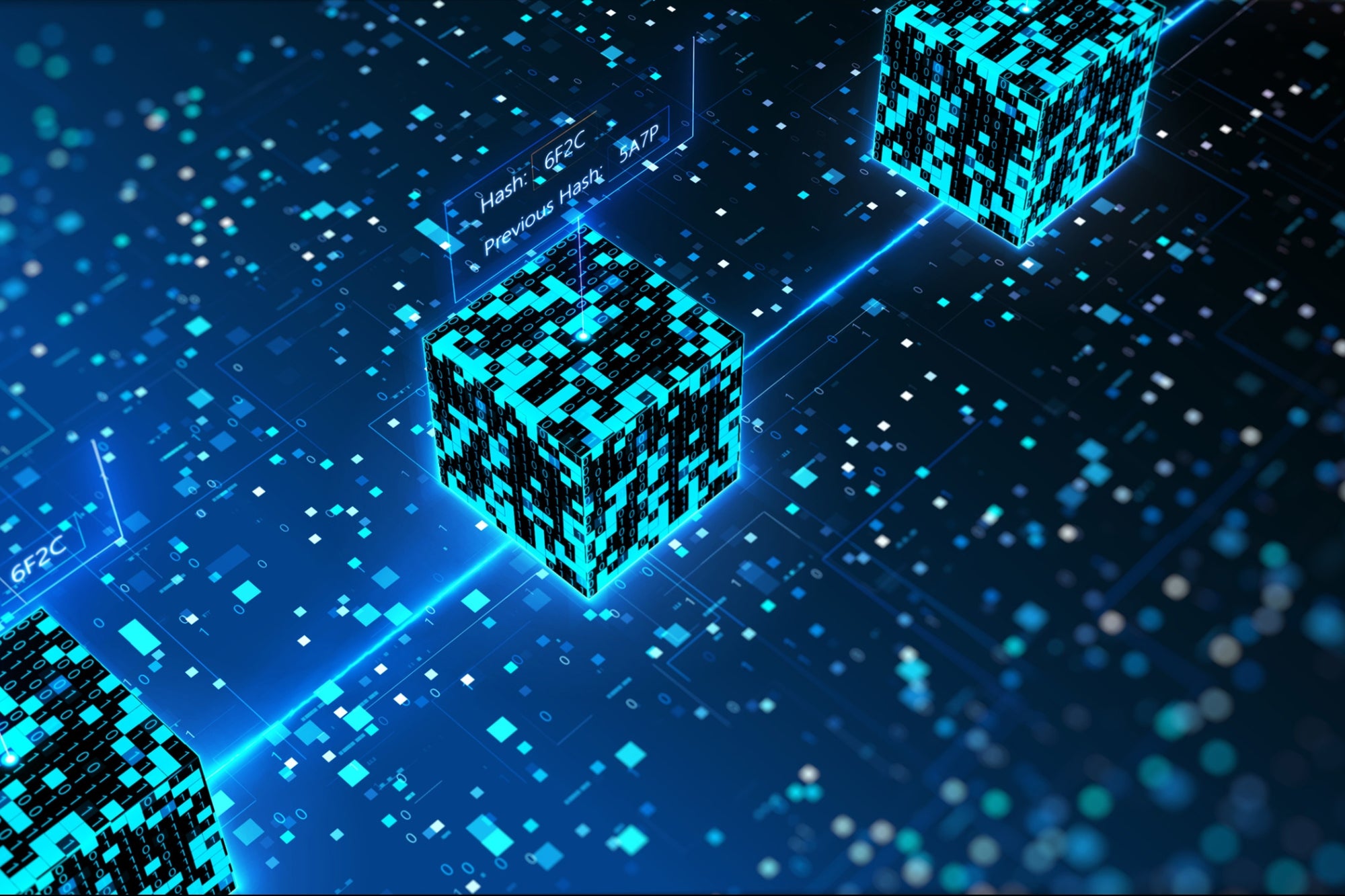

The foundation of unprecedented shift global finance is changing. In Washington, cryptocurrency is accepting more, President Donald Trump established a strategic Bitcoin Reserve and signed the supernatural intelligence law. Meanwhile, the state treasury is adding bitcoin to their balance sheet and public companies are taking part in their reservation in Bitcoin.

Stablecoins designed to maintain a steady value, digital tokens are also entering the mainstream. Companies that issue stablecions are passing publicly through the IPO and the blockchain technology is directly introduced into the regular financial system. The Circle’s IPO marked an important milestone, which shows the increasing confidence on the regulated digital property. According to Blockware’s Q2025 point of view, dozens of public companies are expected to add bitcoin to their balance sheet by the end of the year, an increase of 18% compared to the previous quarter.

We are looking for financial infrastructure, in which traditional finance institutions are starting to notice: Visa is running stablecion-linked debit cards across the US and Africa, while states like Wisconsin are acting like digital gold. Beyond stabbines and crypto holdings, traditional financial giants are already accepting tokenization. Blackcock, Franklin Templeton, City and other tokenizide funds are launching, searching for real-time payments, and investing in smart contrast infrastructure. Organizations such as Blackcock and JP Morgan are already offering tokenized assets and settlement processes on blockchain.

Traditional organizations, with their compliance rigidity, global reach and reliable infrastructure, have given a specific place to lead in the next phase of blockchain finance. Financial leaders must work strategically to help in future size-or the risk of playing cat-up.

When said, traditional organizations can take four steps here to lead the blockchain finance.

Related: Explore the transformative capacity of blockchain in banking and financial services

1. Follow the institutional signal

There are now approximately 135 public companies that keep Bitcoin as a reserve property. Where organizations invest in capital and build infrastructure, what will be scale, regulatory support, provides a clear signal that will be integrated globally. As digital finance develops, it is no longer a hypar but is actually adopting a real-world in billions of organizational investments.

A smart initial point for traditional institutions is to align with players who create a underlying rail for blockchain finance. Circle’s IPO, for example, showed strong confidence in investors in regulated digital finances. On the first day of the trade, the price of the circle’s shares increased 168%, closed at $ 81.69, which increased the infrastructure of stablecions and digital dollar infrastructure and have long -term pillars of the evolving financial system.

2. Invest in the bank’s infrastructure facilities

Instead of just focusing on the token, pay attention to the system that rotates, settles, and safely and follows. This is where you will get a long -term value. Making a visa to support stablecoin transactions modernizes how the circle’s attention and money move on the infrastructure for backnd, digital dollars (USDC). The idea of changing banks is not an idea of changing the level of financial infrastructure that can live together instead of established systems.

Related: 3 interesting benefits of blockchain and how can they change finance

3. Align early with regulators and partners – compliance – first innovative

Regulatory alignment is a strategic advantage in blockchain finance. From the beginning, organizations that bring the regulatory, legal team and strategic partners into the process will move fast and face less obstacles. The most successful blockchain strategies have been created on transparency, auditability, and interoperatively with a comprehensive financial system.

The Drex CBDC Pilot of Brazil is an example, where the Central Bank cooperated to embed down the blockchain under regulatory observation with major players such as Visa, Santalander, Microsoft and Chenleink. The partnership ensures clear guidelines for privacy, administration and regulatory compliance. TradeFI organizations should take the same approach: by investing legal, regulatory and environmental shareholders quickly, they can increase adoption, reduce risk and increase trust.

4. Education and align with internal teams

The success of any blockchain venture does not depend on the single technology, but in legal, compliance, IT and manufacturing teams how well it is understood and implemented. For traditional financial institutions, Blockchain introduced new operating models around the closet, settlement, reporting and data privacy. Before starting any blockchain pilot, the leadership should prioritize internal education, workshops and alliance planning. The largest driver is the education of adaptation in crypto space. Digital property education is essential to help grow in the industry, whether they are investing or companies.

Related: How Blockchain will transform traditional finances as we know

Traditional organizations considering integration of blockchans should be considered as the foundation of future financing. The most successful adoption people who invest in infrastructure, regulatory alignment and internal education early. Blockchain Infrastructure is already unlocking fast, cheap payments, real-time finance operations and new ways of engaging in customers, partners and global markets. Now the working organizations will help to define operational, regulatory, and technical standards that shaped how the blockchain is integrated into modern finance.

Greater regulatory clarity with cooperation and partnership in the industry will be the key to calculating digital property in traditional finance. When regulators, traditional financial institutions and finte innovations work together, they can create a future of finance and money.

The foundation of unprecedented shift global finance is changing. In Washington, cryptocurrency is accepting more, President Donald Trump established a strategic Bitcoin Reserve and signed the supernatural intelligence law. Meanwhile, the state treasury is adding bitcoin to their balance sheet and public companies are taking part in their reservation in Bitcoin.

Stablecoins designed to maintain a steady value, digital tokens are also entering the mainstream. Companies that issue stablecions are passing publicly through the IPO and the blockchain technology is directly introduced into the regular financial system. The Circle’s IPO marked an important milestone, which shows the increasing confidence on the regulated digital property. According to Blockware’s Q2025 point of view, dozens of public companies are expected to add bitcoin to their balance sheet by the end of the year, an increase of 18% compared to the previous quarter.

We are looking for financial infrastructure, in which traditional finance institutions are starting to notice: Visa is running stablecion-linked debit cards across the US and Africa, while states like Wisconsin are acting like digital gold. Beyond stabbines and crypto holdings, traditional financial giants are already accepting tokenization. Blackcock, Franklin Templeton, City and other tokenizide funds are launching, searching for real-time payments, and investing in smart contrast infrastructure. Organizations such as Blackcock and JP Morgan are already offering tokenized assets and settlement processes on blockchain.

Traditional organizations, with their compliance rigidity, global reach and reliable infrastructure, have given a specific place to lead in the next phase of blockchain finance. Financial leaders must work strategically to help in future size-or the risk of playing cat-up.